One of the most important components of any business plan is identifying the funding needs of the business. Funding needs can vary depending on the stage of the business, the industry, and the growth plans.

Here are some key components to consider when determining the funding needs of a business:

Start-up Costs: Start-up costs are the expenses incurred when setting up a new business, such as legal fees, rent, equipment, and marketing. It's essential to identify all the start-up costs to determine the amount of funding required to launch the business.

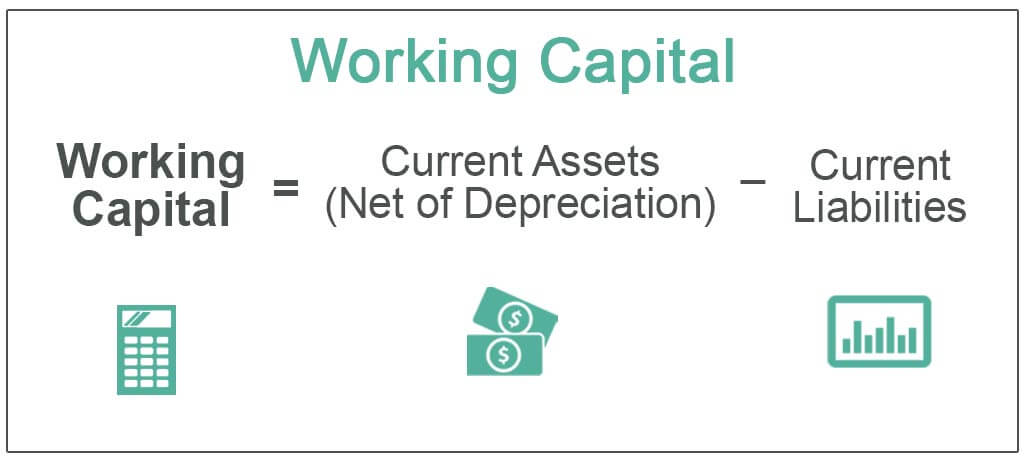

Working Capital: Working capital is the money required to run the day-to-day operations of the business. It includes expenses such as payroll, rent, utilities, and inventory. It's important to have enough working capital to ensure the business can operate smoothly without running out of cash.

Growth and Expansion: If the business is planning to grow and expand, it will require additional funding to support these activities. This can include hiring new employees, expanding into new markets, or investing in new technologies or products.

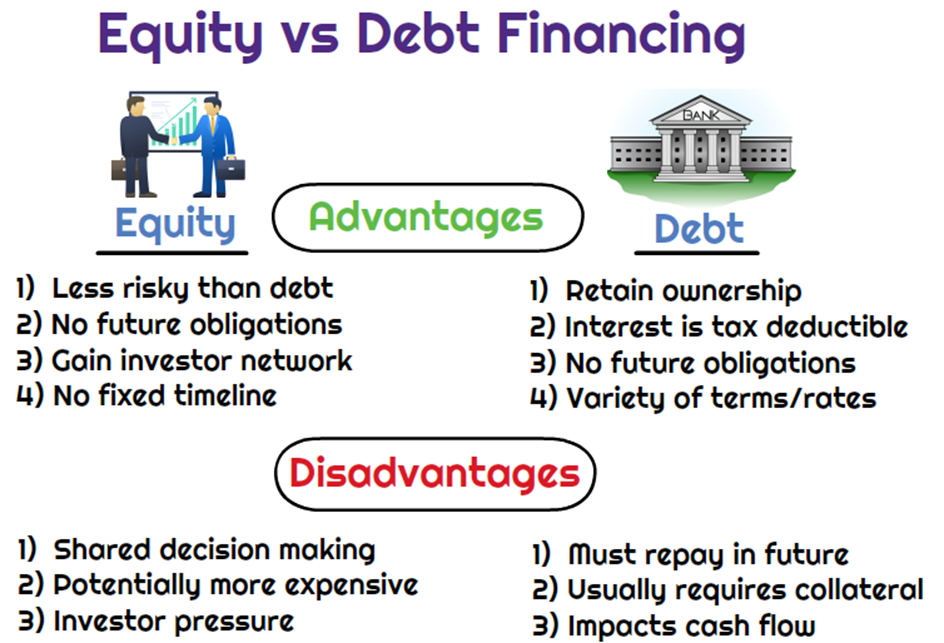

Debt vs. Equity Financing: There are two primary sources of funding for businesses: debt financing and equity financing. Debt financing involves borrowing money that must be repaid with interest, while equity financing involves selling ownership stakes in the business in exchange for investment capital. It's important to determine the best mix of debt and equity financing to meet the business's funding needs.

Investor Requirements: If the business is seeking outside investment, it's important to understand the investor's requirements. This can include the expected return on investment, the length of the investment period, and the level of involvement in the business.

Contingency Planning: It's important to plan for unexpected events that can impact the business's funding needs. This can include economic downturns, regulatory changes, or unexpected expenses.

0 Comments